TECHNOLOG – Main Challenges For The Application Of LNG

When in mid-2012 the trough in the shipping and shipbuilding industry became attractive for UASC to launch their major fleet expansion scheme with a most sophisticated RFP (Request for Proposal) for altogether 17 Nos. Ultra Large Container Vessels this caught the potential interest by all major ship builders. The timing permitted the owner to define very early his needs and to find support for the development of innovative vessels in partnership between the owner’s new-building team, key manufacturers and the potential builders for these new and most economical and ‘green’ ships. Eventually UASC ordered eleven 14,500 TEU (A14) and six 18,800 TEU (A18) ships from Hyundai Heavy Industries and Hyundai Samho Heavy Industries, which will be under DNV Classification and will come into service between end of 2014 and autumn 2016. These new vessels have been prepared for LNG. They will be the first mega container ships designed for dual fuel operation with LNG endurance of halfround voyage in the Asia to Europe trade. The basic engineering has been made in close dialog between builder, owner’s new-building team with included TECHNOLOG engineers, and JMU as supplier of the SPB tank. The Approval in Principle by DNV has been gained.

The main challenges for the application of LNG are:

- Competitiveness of the new ships with lowest slot costs during all operation periods

- Least fuel costs considering stages of MARPOL IV regulations and deadlines on permissible NOX and SOX, as well as best Energy Efficiency Design Index (EEDI) with least CO2 output.

- Selection of most suitable LNG tank system for space requirement and Boil-off Gas handling

- Least investment costs for entire LNG plant as well as retrofit costs

- Minimum loss of container slots for LNG tank and LNG system

- Sustainability of LNG preparations with IMO IGF-Code development with reference to safety distance of tanks to shell and requirements of cofferdams and A60 insulation compared to later competition.

- Availability of bunker volumes for large scale application

- Gradient of LNG bunker prices between Europe and Asia

- Bunkering procedures for least loss in ship operation times and not to deviate from shipping routes and ports of call

- Training of crew for LNG

Slot costs are influenced by Capital Costs for the vessel such as initial investment and financing cost but also LNG retrofit costs, Operating Costs such as bunker costs, crew costs, Suez Canal and port fees, maintenance costs, and available / loaded Container numbers, respectively lost container positions.

For a long time the “hen and egg” principle dictated the stand-still in the maritime industry. The ship owners did not want to invest into LNG as ship fuel technology because they did not get reliable market prices for this fuel and could not determine competitive fuel costs compared to conventional liquid fuels. The LNG logistic companies could not invest into new LNG bunkering infrastructure because with reluctant ship owners there was no LNG demand and no visible consumption volumes to allow investments. Only in Norway experience was gained with LNG application made attractive with government support, but limited to small scale LNG consumption.

With all 17 ULCVs of UASC having their keel laying before the end of 2015 they will be IMO Tier II vessels. NOX values are of lesser concern for ships with keel laying before 01.01.2016, but SOX in ECA zones of presently 1.0% sulphur will drop by end 2014 to 0.1% sulphur only, and global limits will drop in 2020 from 3.5% sulphur to then 0.5% with uncertainties for delay until 2025. For EU waters there will be a limit of 0.5% sulphur from 2020 in any case applicable to EU part of Mediterranean Sea. This will have impact to all ships and their fuels irrespective of age. Low sulphur fuels are expected to become a blend of distillates and HFO but with eventually higher fuel prices. Simultaneously it is expected that the availability of HFO will vanish by 2025 due to the higher efficiency of refineries to crack the crude oil into more earning products.

Cargotec-MacGregor was fully integrated in the design process not only in the series of smaller STREAM Container Vessels but as well in the planning and design of UASC Ultra Large Container Vessel A14 and A18 class. The lashing bridge is not only a hull component but an important part of the cargo system. With the right lashing bridge design the owners and operators can benefit from higher cargo intake capacity and better lifetime earnings. As responsible System Supplier Cargotec-MacGregor is responsible for hatch covers, cell guides, lashing-bridges and lashing equipment and system functioning.

Cargotec-MacGregor was fully integrated in the design process not only in the series of smaller STREAM Container Vessels but as well in the planning and design of UASC Ultra Large Container Vessel A14 and A18 class. The lashing bridge is not only a hull component but an important part of the cargo system. With the right lashing bridge design the owners and operators can benefit from higher cargo intake capacity and better lifetime earnings. As responsible System Supplier Cargotec-MacGregor is responsible for hatch covers, cell guides, lashing-bridges and lashing equipment and system functioning.

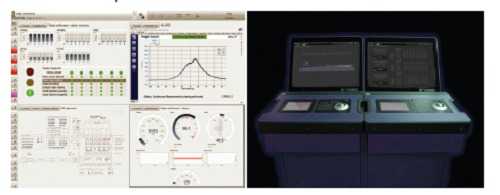

For all UASC new-buildings Kongsberg is delivering their Vessel Performance System which includes an Energy Management Module. This is part of the vessel Integrated Automation System developed in cooperation with Marorka. This provides full-fledged automated energy management solution as a part of the Full Picture solution.

The Alfa Laval steam system for Waste Heat recovery system is developed though many years of experiences and in good cooperation with the other partners in the supply chain, owners and designers and was chosen for all UASC newbuildings. For full utilisation of the complete system and fulfil the operational expectations to the vessel is it therefore important to select suppliers who has the required knowledge not only to their own supply but indeed have detailed experiences to the complete supply chain and know the consequences if, for example, parameters on the engine are changes what will happen down steam in the Waste Heat Recovery System.

The Alfa Laval steam system for Waste Heat recovery system is developed though many years of experiences and in good cooperation with the other partners in the supply chain, owners and designers and was chosen for all UASC newbuildings. For full utilisation of the complete system and fulfil the operational expectations to the vessel is it therefore important to select suppliers who has the required knowledge not only to their own supply but indeed have detailed experiences to the complete supply chain and know the consequences if, for example, parameters on the engine are changes what will happen down steam in the Waste Heat Recovery System.

Siemens AG as selected System-Supplier is providing the combines shaft generator-motor and the complex power management system (PMS) including optimized use of engine exhaust power.

Every selected Sauer Passat WP121L was individually checked in the factory for at least 16 hours, documented by an inspection certificate.

Generator sets are coming for UASC vessels from NISHISHIBA ELECTRIC CO.,LTD. The picture below is showing the first diesel generator coupled with HYUNDAI’s DF engine.

First Stern-tube-bearings from SFK Blohm & Voss Industries GmbH are ready for on-board installation

Becker Marine System is fabricating and delivering for these new-buildings the TLKSR Twisted Rudder and BMS Twisted Fins

UASC has selected Hoppe Marine as system supplier for VRC, Anti-Heeling and Tank Content Measuring System. Hoppe Marine’s innovative and clean pneumatic VRC will be applied, which supplies the actuator air in the same proprietary hybrid cable HOCAB as the actuator status signal. This makes a separate air piping system and its necessary bulkhead penetrations and clamps redundant, which is a cost advantage for both the shipyard due to reduced outfitting cost and the operator by lower life cycle cost.

The price of LNG – at least in Europe – is expected to be of same value as low calorific HFO. Various ports in Europe claim to be ready for large scale LNG supply by mid-2016 and LNG supply companies provide first indications on a longer term bunkering commitment. But also in the Far East there are great activities to establish facilities, but eventually bunkering logistics will all come down to commercial benefits. With the extremely low LNG prices in the U.S.A. it is expected that there will be in future extensive LNG trading along the major shipping routes to level out the large LNG price differences between Europe and the Far East. Also the gas producers in Middle East will build up their infrastructure and will have the potential for most competitive bunkering facilities. UASC ships could here become a key focus.

So it is not a question any more whether it will be right to change from conventional liquid fuels gaining steadily in price to the increasingly cheaper LNG, but it will be a cost/benefit analysis of when to change with acceptable payback time for the additional LNG plant and system investment. With the increasing environmental consciousness of global warming by coastal countries Emission Controlled Areas will certainly increase. With application of LNG also the NOX levels for IMO Tier III will be met.

UASC has decided for LNG as fuel rather than to invest into scrubbers and SCR’s, and with this decision has accepted the role as market leader for LNG as ship fuel with mega box container carriers.

Quote of words from J. Hinge, UASC President and CEO issued April 18th 2014:

“UASC now has seventeen new vessels on order; six 18,000 TEU and eleven 14,000 TEU containerships. The cutting edge vessel designs adopted by UASC have been developed focusing on cost efficiency and enhanced environmental friendliness. These vessels will be the first large containerships that will be ‘LNG ready’ at delivery with dual fuel capability once the required LNG bunkering infrastructure is in place”.

By mid-2016 the industry will be ready and UASC with their selected partners will march on with the present momentum to convert their ships to LNG soonest. TECHNOLOG with their STREAM 4500 LNG design have signed a LOI for a number of ships and could win an order also for the slightly larger STREAM 5000 LNG open top vessel. These ships will not be run in the Europe to Asia trade but LNG tanks and LNG systems can be designed also for other routes and services with respective endurance.

TECHNOLOG Group of companies is represented at SMM 2014 in Hall B5, Booth 304 Hamburg, July 2014 – Albrecht Delius, Berend Pruin

For the time being the TECHNOLOG Team in cooperation with UASC’s special project taskforce and many specialized suppliers are supporting the shipyard in elaboration final design for construction which has already started in March 2014 at Hyundai Heavy Industries in Korea.

Finally it has to be mentioned that Mecklenburger Metallguss GmbH has always been involved as JIP for all STREAM designs including ice-classed ones.